The Federal Tax Authority (FTA) of the United Arab Emirates has recently released a vast digital initiative referred to as the ‘Maskan’ smart app. This app is designed to facilitate the re-funding of value-added tax (VAT) for UAE residents who’re building new homes. The introduction of Maskan aligns with the FTA’s broader strategy to boost virtual transformation and streamline tax services, reflecting the national priorities of the UAE.

Overview of the Maskan Smart Application

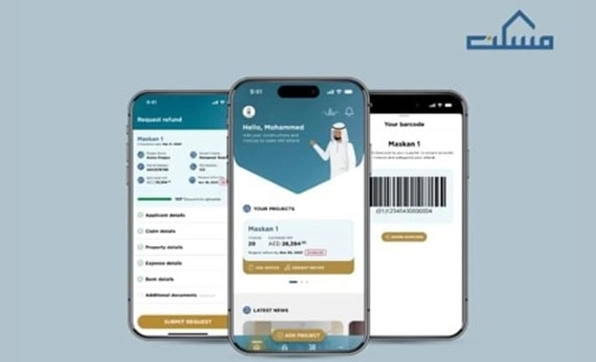

The Maskan app serves as a virtual platform tailored for UAE nationals in search of VAT refunds on expenses incurred at some stage in the development of their residences. This initiative is mainly applicable to developing emphasis on virtual solutions in authorities’ services, aiming to make approaches more efficient and person-friendly for citizens.

Key Features of the Maskan Smart App

- User-Friendly Interface

The app is designed with an intuitive interface that permits customers to navigate effortlessly via the various functionalities, making the VAT recovery method reliable.

- Efficient VAT Recovery Process

Maskan streamlines the procedures involved in claiming VAT refunds, making sure that users can complete their applications fast and with minimal problems.

- Real-Time Tracking

Users can tune the status of their VAT refund packages in real-time, providing transparency and decreasing uncertainty all through the process.

- Comprehensive Support

The app gives support and guidance for customers, helping them understand the necessities and documentation needed for a successful VAT refund claim.

- Integration with Existing Systems

Maskan integrates seamlessly with other FTA structures, taking into account a cohesive revel in when handling tax-related offerings.

Importance of the Initiative

The launch of the Maskan application is a testament to the FTA’s dedication to enhancing the digital panorama of tax offerings inside the UAE. By simplifying the VAT recuperation procedure, the FTA not only helps citizens manage their tax responsibilities but additionally encourages compliance with tax policies.

Alignment with National Priorities

This initiative is part of a broader vision set forth by the UAE authorities to sell digital transformation throughout numerous sectors. The UAE has been at the leading edge of adopting modern technology to improve public offerings, and the advent of Maskan is a great step on this path. It reflects the authorities’ determination to supply efficient and on-hand offerings to its residents, thereby enhancing their basic quality of life.

Benefits for UAE Citizens

The Maskan utility gives several benefits for UAE residents, mainly the ones involved in home creation.

- Financial Relief:

By facilitating VAT refunds, the app can alleviate a number of the financial burdens associated with building a brand new home, making it more affordable for residents.

- Encouragement of Home Ownership:

The ease of recovering VAT may also encourage greater citizens to invest in domestic construction, contributing to the overall boom of the real property area in the UAE.

- Enhanced User Experience:

The virtual nature of the application guarantees that citizens can control their tax affairs at their convenience, reducing the desire for in-person or female visits to tax workplaces.

- Support for Economic Growth:

By streamlining tax processes, the Maskan utility supports the wider financial goals of the UAE, fostering a more robust and dynamic economic system.

Future Prospects

Looking ahead, the FTA’s launch of the Maskan utility is probably to pave the way for added digital tasks aimed toward enhancing tax services. As generation continues to conform, the FTA may additionally explore new functions and functionalities that may be included in the utility, ensuring that it remains relevant and useful for customers.

Continuous Improvement

The FTA is committed to constantly enhancing its services primarily based on user reviews and technological advancements. This technique will make sure that the Maskan application not only meets the modern-day demands of UAE residents but additionally adapts to future challenges and opportunities in the tax panorama.

Conclusion

The introduction of the Maskan smart app by means of the Federal Tax Authority marks a sizable milestone inside the UAE’s adventure in the direction of digital transformation in public services. By facilitating VAT recovery for domestic construction costs, the application addresses an essential need for UAE residents, even as it aligns with country-wide priorities for reinforcing performance and accessibility in tax services. As the FTA keeps innovating and enhancing its offerings, the Maskan application stands as a testament to the UAE’s commitment to leveraging generation for the benefit of its residents.

FAQs

What is the Maskan app?

The Maskan app is released by way of the UAE FTA to simplify VAT refund methods for UAE residents.

Who can use the Maskan app?

UAE citizens eligible for VAT refunds can use the Maskan app to streamline their refund claims.

What are the advantages of the usage of the Maskan app?

The app gives a person-friendly interface, quicker processing of VAT refunds, and stronger transparency.

How can I download the Maskan app?

The Maskan app can be downloaded on both Android and iOS platforms. Users can find it on their respective app stores.