The Federal Tax Authority (FTA) imposed the Value Added Tax (VAT) in the United Arab Emirates (UAE) on 1st January 2018. The widespread VAT rate in UAE is 5%. Every VAT-registered commercial enterprise in UAE must pay VAT whilst shopping for goods or services and acquire VAT whilst selling them. So, calculating VAT is an everyday pastime for any type of enterprise. This article will delve into the VAT calculation method and how vat consultants in dubai can help in calculating the VAT by compliance with regulations set by the authority in UAE.

What is VAT?

VAT falls underneath indirect taxation and is imposed on the sale and import of products and services, with positive exceptions. More than one hundred sixty nations around the world are enforcing the VAT system. VAT is paid and gathered by the consumer and seller, respectively, at every stage of the supply chain. Suppose, inside the case of a manufacturer, from shopping raw substances by way of the producer till a retailer sells the quit product to a patron. The United Arab Emirates (UAE) government brought VAT w.E.F 1st January 2018 and commenced charging 5% for taxable sales and imports.

VAT calculation formulation

There are two strategies to do VAT calculation in UAE. In the primary one, you must upload VAT to the sale rate; in the 2nd one, you must exclude the VAT from the sale fee. Let’s see separately:

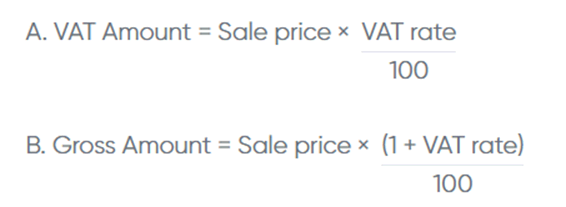

- Adding VAT to the sale charge: This approach is used while VAT isn’t always covered in the sale rate. Below are the formulas to add the VAT to the sale price:

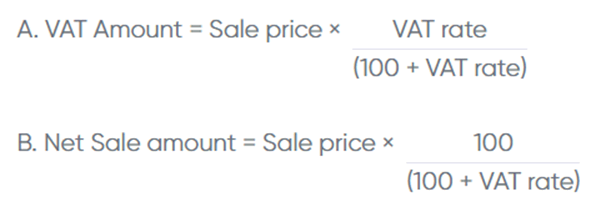

- Excluding VAT from sale rate: This technique is used when VAT is protected in the sale rate. You can use the underneath formulas to exclude VAT from the sale fee:

VAT calculation example

Let’s understand VAT calculation using an example.

Sale quantity = AED 1,000

VAT rate = 5%

When the sale price is exclusive of VAT:

- VAT amount = AED 1,000 x (5/one hundred) = AED 50

- Gross amount = AED 1,000 x (1 (5/one hundred)) = AED 1,050

When the sale price includes VAT:

VAT quantity = AED 1,000 x (5/(100+ 5)) = AED 47.62

Net sale amount = AED 1,000 x (100/ (100+ 5)) = AED 952.38

What are input VAT and output VAT?

The VAT machine is largely primarily based at the enter VAT and output VAT. Let’s recognize these with examples.

- Input VAT

The tax paid on purchasing items or offerings is known as input VAT.

Suppose: Mr Rashid purchased goods worth AED 5,000 + 5% VAT from Sultan Distributors. The tax of 250 paid by Mr Rashid is an input VAT.

- Output VAT

The tax accumulated even as selling items or offerings is known as output VAT.

Suppose: Mansour sold items well worth 10,000 with 5% VAT to Raheem Enterprises. The VAT of 500 amassed by means of Mansour is an output vat.

How to calculate VAT charge?

VAT-registered taxpayers pay VAT after deducting enter VAT (paid on purchases) from the output VAT (amassed on income). You can arrive at the internet VAT payable the use of the beneath system:

Net VAT charge = Output VAT – Input VAT

You need to document the total output VAT gathered and input VAT paid for the duration of the tax duration. You can apply the above formulation once you have calculated the output and enter VAT.

If your output VAT exceeds the input VAT, the difference can be the VAT payable. Suppose the output VAT is much less than the Input VAT; you don’t want to pay tax, and could get the refund.

Looking for a VAT consultant in Dubai? Get expert guidance on calculating VAT effectively, ensuring compliance, and optimizing your financial strategy.

FAQs

How is the VAT calculated in UAE?

You ought to upload a 5% VAT to the sale charge. For instance, the taxable products/offerings fee is AED 100; the client has to pay the VAT of AED 5 (AED one hundred x 5%).

What is the VAT rate in UAE?

The standard VAT price is 5% in UAE. However, the government categorized a few goods and services beneath exempt and zero-rated resources wherein no tax is charged.

How do you add 5% VAT on a calculator?

You must input the sale charge and multiply it with the (1 VAT price) to acquire the gross amount to be gathered.

How do you exclude VAT from the charge of a product?

You’ve to exclude the VAT from the sale- price the usage of the second one technique referred to above.

What is the VAT calculation Formula to calculate VAT in UAE?

VAT = Price including tax x (VAT fee ÷ (one hundred VAT rate))

What is the VAT on one hundred?

For instance, if the fee of the product is AED (100) one hundred, if so, the Input VAT could be 100×5%= AED 5.00.